At issue are branches of foreign banks, the vast majority of which are overseen by a partnership of both state and Federal Reserve regulators.

"A continuing role in regulating the U.S. operations of foreign banking institutions gives the Fed an important window into systemic risk worldwide," Neiman said to a gathering of international bankers in Washington.

Well, there you have it, that is why the Fed needs supervision over the foreign banking institutions. But right now the problem is . . .

Dodd would remove the Fed's examination authority over banks and place that responsibility within the new consolidated bank regulator. This would leave the Fed to concentrate solely on monetary policy.

But, Ben Bernanke argued that without supervision over central banks, he and his committee will have a hard time identifying the risks and thus they will not be able to set up an effective monetary policy that will benefit the majority.

Personally, I feel that it is not wise to deny the Fed of all supervision over central banks. At the end of the day, the central banks are so-called the pillar of the economy. They are the bellwether of the economy; any changes in the loans will have a great impinge on the society.

This includes investments, expenditures, expansion projects and further developments opportunities in the future. The banks hold the assets and the Fed needs to know how much they hold and how are they handling out the loans.

Without an overview of their operations, the Fed might end up setting policies that go against these banks. Rather than supporting the bank's policies, the Fed might end up giving these banks a hard time, which is not intended in the first place.

Hence, it is imperative to allow the Fed to retain control over the renowned central banks like those in Japan, Europe and America. Otherwise, they will not be able to churn out the apposite policy that is beneficial to all.

Credits -adrem, -ceoworld, -the217

Showing posts with label Companies. Show all posts

Showing posts with label Companies. Show all posts

Monday, May 10, 2010

Saturday, May 8, 2010

AT&T Shares iPhone

Previously, the iPhone can only be operated on a GSM network but everything is going to change soon. In the future, the iPhone will be able to be operated on a CDMA network used on Verizon as well.

With the leverage provided, the prerogative of AT&T is ending. Soon, Verizon will join in the gladiator fight and we will see some fierce and intense competition between the both of them once again.

AT&T and Verizon are de facto competitors with a symbiosis relationship rather than destructive one. They help each other improve their products, their lines, their collaborators and their price policies as well.

A while back, we see AT&T lowering their price plans to encourage people to sign up for their data plans and immediately, you see Verizon following suit.

They keep up with the trend by following not just the market, but tagging close to their competitor. From this case, we can see the epitome of competitiveness, to never let your competitor lose your sight.

That is the key of business. They are a great source of benchmark for you to keep yourself updated.

Nonetheless, we should not always be dependent on them for news or we will be lagging behind and there will be little chances of our own breakthrough. Of course, we should go more into Research and Development now which is a hot field.

Look at neuromarketing, and the fact that people are improving their price plans goes to show that they are focussing on the importance of data plans

Why is data plans so important ? Well, simply put, an increasing number of people are surfing the net via their handphones and smartphones rather than on the net. We are constantly on the move now and at the same time, we need to be updated. So where do we get the news from? From our smartphones of course.

Equipped with the latest technology, iPhone has thousands of applications for you to enjoy both in terms of play and work.

Hence, AT&T might not really lose even though Verizon has gotten the rights to allow the iPhone to work on their network.

In fact, I believe that it will benefit AT&T more than ever. Afterall, being a sole distributor is insidious, for it will stultify you before you know it!

Credits -buffalothrillsbusiness, -larryfire, -cnn

With the leverage provided, the prerogative of AT&T is ending. Soon, Verizon will join in the gladiator fight and we will see some fierce and intense competition between the both of them once again.

AT&T and Verizon are de facto competitors with a symbiosis relationship rather than destructive one. They help each other improve their products, their lines, their collaborators and their price policies as well.

A while back, we see AT&T lowering their price plans to encourage people to sign up for their data plans and immediately, you see Verizon following suit.

They keep up with the trend by following not just the market, but tagging close to their competitor. From this case, we can see the epitome of competitiveness, to never let your competitor lose your sight.

That is the key of business. They are a great source of benchmark for you to keep yourself updated.

Nonetheless, we should not always be dependent on them for news or we will be lagging behind and there will be little chances of our own breakthrough. Of course, we should go more into Research and Development now which is a hot field.

Look at neuromarketing, and the fact that people are improving their price plans goes to show that they are focussing on the importance of data plans

Why is data plans so important ? Well, simply put, an increasing number of people are surfing the net via their handphones and smartphones rather than on the net. We are constantly on the move now and at the same time, we need to be updated. So where do we get the news from? From our smartphones of course.

Equipped with the latest technology, iPhone has thousands of applications for you to enjoy both in terms of play and work.

Hence, AT&T might not really lose even though Verizon has gotten the rights to allow the iPhone to work on their network.

In fact, I believe that it will benefit AT&T more than ever. Afterall, being a sole distributor is insidious, for it will stultify you before you know it!

Credits -buffalothrillsbusiness, -larryfire, -cnn

Saturday, May 1, 2010

Natural gas: Fuel of the future

This gas has been known about for some time, but new drilling and extraction technology has now made it commercially viable.

"There's a lot of conservatism right now," he said in an interview with CNNMoney. "We're just at the very tip of this pyramid."

'It's a question of believing," said Tertzakian, who also thinks the estimates for future natural gas use are low. "Once they believe the trend, gas demand is more likely to gain momentum."

If you all can remember, Exxon has just recently acquired XTO Energy for a total of 41 billion dollars. If Exxon sees something there, I'm pretty sure they are right.

They are definitely not playing a hit-or-miss game. Exxon has always been acute with its investments and this is a particularly big one so there's no way Exxon will get it wrong.

At least, I have 101% confidence that this is the right investment for Exxon. Being the number producer of oil, it is not going to leave the position now that it is reaping the profits from the natural gas boom.

Soon, the boom will die down and everyone will realise just how great natural gas is and how they are actually in surplus out there. It is a matter of who gets them first before they run out.

But in making electricity, it could have real benefits. Ming, from Secure Energy, said that used in the most efficient power plants, natural gas is actually 70% cleaner than coal.

Yes, so there you have it, we now know that natural gas is actually undermined by coal and that it will eventually emerge victorious. It is gaining market share at a rapid rate and estimates have been conversative till now.

It is going to shock everyone in the near future so just you wait guys. Natural gas will be your main source of fuel for all your products before you know it.

More technology will be developed to extract the natural gas from shale more easily and water pollution will definitely be taken care of.

This is de facto synonymous to that of the 3D technology, it has been here for quite some time already but no one has really noticed its potential yet. But everything is changing, natural gas is here to stay! It is becoming more flagrant a fact that natural gas is the fuel of tomorrow!

Start to invest in natural gas and you will be rich before you know it.

Credits -cnn, -culturefeast, -linde, -sxc

"There's a lot of conservatism right now," he said in an interview with CNNMoney. "We're just at the very tip of this pyramid."

'It's a question of believing," said Tertzakian, who also thinks the estimates for future natural gas use are low. "Once they believe the trend, gas demand is more likely to gain momentum."

If you all can remember, Exxon has just recently acquired XTO Energy for a total of 41 billion dollars. If Exxon sees something there, I'm pretty sure they are right.

They are definitely not playing a hit-or-miss game. Exxon has always been acute with its investments and this is a particularly big one so there's no way Exxon will get it wrong.

At least, I have 101% confidence that this is the right investment for Exxon. Being the number producer of oil, it is not going to leave the position now that it is reaping the profits from the natural gas boom.

Soon, the boom will die down and everyone will realise just how great natural gas is and how they are actually in surplus out there. It is a matter of who gets them first before they run out.

But in making electricity, it could have real benefits. Ming, from Secure Energy, said that used in the most efficient power plants, natural gas is actually 70% cleaner than coal.

Yes, so there you have it, we now know that natural gas is actually undermined by coal and that it will eventually emerge victorious. It is gaining market share at a rapid rate and estimates have been conversative till now.

It is going to shock everyone in the near future so just you wait guys. Natural gas will be your main source of fuel for all your products before you know it.

More technology will be developed to extract the natural gas from shale more easily and water pollution will definitely be taken care of.

This is de facto synonymous to that of the 3D technology, it has been here for quite some time already but no one has really noticed its potential yet. But everything is changing, natural gas is here to stay! It is becoming more flagrant a fact that natural gas is the fuel of tomorrow!

Start to invest in natural gas and you will be rich before you know it.

Credits -cnn, -culturefeast, -linde, -sxc

Sunday, April 25, 2010

Cisco's Winning Router

These ad hoc equivalency benchmarks lingered over the years and have now returned with a vengeance with the Cisco CSR-3 and its outrageous 322 terabits-per-second throughput (Tbps).

So Cisco rolls out this phenomenal router that will obviously feed some of the most expensive bundles of fiber and lots of them.

Every person in China can make a simultaneous video phone call.

Every movie ever made in Hollywood for all time can be downloaded in 4 minutes.

The entire contents of the Library of Congress can be downloaded in one second.

This is all nonsense of course, because the pipes between the router and the data are not big enough to come close to allowing these events. And the ability of hard disks, where such data would be stored, cannot come anywhere near these throughput speeds. Definitely not feasible for sure!

Yes, all of the above mentioned are not realistic but the point is, it has that huge amount of potential, that if the pipes can be enlarged in the future, all these can be easily achieved because the transmission speed is appallingly high.

We all know anything is possible. Nothing is impossible today.

Welcome to the technological age. We all know that Cisco is the Number 1 superpower when it comes to servers and routers but boy do we not know that it can come up with something so ridiculous!

It's ineffable to be honest. It can even be considered as an incandescent breakthrough so to speak.

Did I mention that this thing cost $90,000? Well, considering its capabilities, it is dirt-cheap, trust me! But then again, it was never meant for a consumer, because it will lead to more piracy and illegal stuff being committed along the way with such a powerful router. Who knows what the public will do with it!

Anyway, this router is actually pivotal for super gargantuan businesses that require transmission of data at lightning speed so that all the operations can be run efficiently and smoothly without a single breakdown or lagginess.

An example of which will be DHL where it has to handle millions of orders throughout. This router could help DHL detect where the package is and every metre it has travelled in a second. It can monitor the movement of the package to that very extent!

Impressive isn't it? But, I'm sure it will be subjected to misused in this maladjusted society today. Hackers, social engineers will definitely use it to commit more fraudulent acts and this might even help them to get away because they can transfer data so fast that the system will not even detect it! By the time the system took note of it, the thief would have already been long gone.

Good or bad, you guys decide!

Credits -marketwatch, -arstechnical, -adeel, -westernexperience

So Cisco rolls out this phenomenal router that will obviously feed some of the most expensive bundles of fiber and lots of them.

Every person in China can make a simultaneous video phone call.

Every movie ever made in Hollywood for all time can be downloaded in 4 minutes.

The entire contents of the Library of Congress can be downloaded in one second.

This is all nonsense of course, because the pipes between the router and the data are not big enough to come close to allowing these events. And the ability of hard disks, where such data would be stored, cannot come anywhere near these throughput speeds. Definitely not feasible for sure!

Yes, all of the above mentioned are not realistic but the point is, it has that huge amount of potential, that if the pipes can be enlarged in the future, all these can be easily achieved because the transmission speed is appallingly high.

We all know anything is possible. Nothing is impossible today.

Welcome to the technological age. We all know that Cisco is the Number 1 superpower when it comes to servers and routers but boy do we not know that it can come up with something so ridiculous!

It's ineffable to be honest. It can even be considered as an incandescent breakthrough so to speak.

Did I mention that this thing cost $90,000? Well, considering its capabilities, it is dirt-cheap, trust me! But then again, it was never meant for a consumer, because it will lead to more piracy and illegal stuff being committed along the way with such a powerful router. Who knows what the public will do with it!

Anyway, this router is actually pivotal for super gargantuan businesses that require transmission of data at lightning speed so that all the operations can be run efficiently and smoothly without a single breakdown or lagginess.

An example of which will be DHL where it has to handle millions of orders throughout. This router could help DHL detect where the package is and every metre it has travelled in a second. It can monitor the movement of the package to that very extent!

Impressive isn't it? But, I'm sure it will be subjected to misused in this maladjusted society today. Hackers, social engineers will definitely use it to commit more fraudulent acts and this might even help them to get away because they can transfer data so fast that the system will not even detect it! By the time the system took note of it, the thief would have already been long gone.

Good or bad, you guys decide!

Credits -marketwatch, -arstechnical, -adeel, -westernexperience

Wednesday, April 14, 2010

Intel plans $3.5 billion investment fund

As mentioned above, Intel plans on a $3.5 billion investment on our posterity.

On prima facie, you might be wondering, why not invest in R&D or something?

Well, this comes down to the fact that human are our best form of resources and assets in business. Without the instrumental human talent, the company's development will be moribund and outdate.

They need an incessant influx of ideas to stay on top of the game, particularly in the technology industry

which is so fast-paced.

Firms including Advanced Technology Ventures, Kleiner Perkins Caufield & Byers and Walden International have committed to "steer investments into technologies that will drive economic growth and job creation in the United States," Otellini said.

As you can see, they are moving into technology that drives job creation like I mentioned above and to stimulate economic growth.

Intel is renowned for the development of chips and processors. By investing more funds in the development of their niche, Intel will emerge as a fierce competitor to all the other players in the industry.

Right now, the economy is still recovering, in its covalescence stage so to speak. Nonetheless, companies are already looking into the possible options of expanding their operations. In turn, they need to retrofit their systems in order to compete more effectively with their competitors.

This is where Intel plays a salient role. That is to provide these companies with the high-performance systems that they need in the new era after this notorious economic crisis. Everyone is picking themselves up and are ready to move on.

In case you did not realise, a lot of companies have been conducting clandestine trainings vigorously during the past year. They did not just sit there and watch how the financial crisis tore their profits apart. Instead, they worked and trained and now, they are stronger than ever before.

All they need now is the apposite technology to support their plans to bring their companies to a whole new position in the field.

And Intel and other IT corporations are just doing that, to help them find the right technology they need by investing in the necessary fields of technology.

Credits -cnn, -robertson, -clabedan, -mystein

On prima facie, you might be wondering, why not invest in R&D or something?

Well, this comes down to the fact that human are our best form of resources and assets in business. Without the instrumental human talent, the company's development will be moribund and outdate.

They need an incessant influx of ideas to stay on top of the game, particularly in the technology industry

which is so fast-paced.

Firms including Advanced Technology Ventures, Kleiner Perkins Caufield & Byers and Walden International have committed to "steer investments into technologies that will drive economic growth and job creation in the United States," Otellini said.

As you can see, they are moving into technology that drives job creation like I mentioned above and to stimulate economic growth.

Intel is renowned for the development of chips and processors. By investing more funds in the development of their niche, Intel will emerge as a fierce competitor to all the other players in the industry.

Right now, the economy is still recovering, in its covalescence stage so to speak. Nonetheless, companies are already looking into the possible options of expanding their operations. In turn, they need to retrofit their systems in order to compete more effectively with their competitors.

This is where Intel plays a salient role. That is to provide these companies with the high-performance systems that they need in the new era after this notorious economic crisis. Everyone is picking themselves up and are ready to move on.

In case you did not realise, a lot of companies have been conducting clandestine trainings vigorously during the past year. They did not just sit there and watch how the financial crisis tore their profits apart. Instead, they worked and trained and now, they are stronger than ever before.

All they need now is the apposite technology to support their plans to bring their companies to a whole new position in the field.

And Intel and other IT corporations are just doing that, to help them find the right technology they need by investing in the necessary fields of technology.

Credits -cnn, -robertson, -clabedan, -mystein

Tuesday, April 13, 2010

Intel and AMD

As cloud computing and virtualization are gaining more recognition in this market.

Cloud computing lets companies to access computing power through a network instead of in-house data centers, while virtualization allows businesses to tap disparate computer systems on their premises or in hosted data centers as one network and tap into that computing capacity.

People are looking and scrutinizing the operations of processors and servers giants. This includes Intel and Advanced Micro Devices.

Intel has come up with a latest version of the Xeon processor that is both more secure and energy efficient. On the other hand, AMD has come up with a more powerful version of its Opteron server.

As you all know, the financial crisis is becoming obsolete, right now businesses are bucking up and ready to rock and roll. But the problem they have currently is that their systems are a little too old to function and to compete with the giant corporations out there.

Hence, the solution is of course to retrofit their systems and bring in new servers and processors.

Other than retrofitting their systems, a majority of the companies are looking into the long-term view. They are developing a strategy that will aid them in the long run and of course the systems they buy must complement their strategies.

Most of the companies are trying to cut down on the processors and energy consumed in order to construct a leaner system that will help lower the cost of production and naturally increase the amount of net profits made every year in order to be able to distribute more dividents to their shareholders, thus boosting their interest level.

So, the main point here is to hunt for systems that will be more energy efficient and at the same time, able to encapsulate all the data of the company in their own intranet systems, which should not be a problem at all for both Intel and AMD.

Storage spaces can easily be manipulated by them and it can be easily be increased by a few folds at one go.

The question then is to save as much energy as possible. We are now living in a green environment where we emphasised on corporate responsibility which is to say that we have to look out for the welfare of the people and environment around us.

By doing that, it is believed that money will naturally be a by-product of this process. People will trust the company and thus invest in it which in turn increase the cash flow of the company. That way, the company will be able to restructure more often and then it will be able to develope quicker and better.

All in all, Intel and AMD has managed to come out with more energy efficient systems just when the businesses out there are almost ready to change their systems.

Kudos to them and I wish them all the best and hopefully they will continue to innovate!

Credits -marketwatch, -apcmag, -redkernel, a-hec, -clipartof

Cloud computing lets companies to access computing power through a network instead of in-house data centers, while virtualization allows businesses to tap disparate computer systems on their premises or in hosted data centers as one network and tap into that computing capacity.

People are looking and scrutinizing the operations of processors and servers giants. This includes Intel and Advanced Micro Devices.

Intel has come up with a latest version of the Xeon processor that is both more secure and energy efficient. On the other hand, AMD has come up with a more powerful version of its Opteron server.

As you all know, the financial crisis is becoming obsolete, right now businesses are bucking up and ready to rock and roll. But the problem they have currently is that their systems are a little too old to function and to compete with the giant corporations out there.

Hence, the solution is of course to retrofit their systems and bring in new servers and processors.

Other than retrofitting their systems, a majority of the companies are looking into the long-term view. They are developing a strategy that will aid them in the long run and of course the systems they buy must complement their strategies.

Most of the companies are trying to cut down on the processors and energy consumed in order to construct a leaner system that will help lower the cost of production and naturally increase the amount of net profits made every year in order to be able to distribute more dividents to their shareholders, thus boosting their interest level.

So, the main point here is to hunt for systems that will be more energy efficient and at the same time, able to encapsulate all the data of the company in their own intranet systems, which should not be a problem at all for both Intel and AMD.

Storage spaces can easily be manipulated by them and it can be easily be increased by a few folds at one go.

The question then is to save as much energy as possible. We are now living in a green environment where we emphasised on corporate responsibility which is to say that we have to look out for the welfare of the people and environment around us.

By doing that, it is believed that money will naturally be a by-product of this process. People will trust the company and thus invest in it which in turn increase the cash flow of the company. That way, the company will be able to restructure more often and then it will be able to develope quicker and better.

All in all, Intel and AMD has managed to come out with more energy efficient systems just when the businesses out there are almost ready to change their systems.

Kudos to them and I wish them all the best and hopefully they will continue to innovate!

Credits -marketwatch, -apcmag, -redkernel, a-hec, -clipartof

Sunday, April 11, 2010

Hewlett-Packard Polycom

Under the agreement, H-P will offer Polycom's video conferencing and telepresence technology through the Palo Alto, Calif. giant's "unified communications and collaboration services" portfolio.

The two companies also agreed to joint efforts to make Polycom's technology inter-operate with HP's Halo telepresence technology.

With Polycom under the tutelage of HP's operational management style, it will definitely prosper in the future. HP is famous for its "HP Way" and it is the reason why it has managed to expand its operations so vastly within a short period of time throughout these years.

On top of that, HP has also been expanding its operations in other fields such as networking solutions. HP acquired 3Com for that very sole purpose of expanding its market share in China. Also, it is experienced when it comes to competition. It has fought IBM and Dell before naturally HP has the upperhand as compared to Cisco.

Nonetheless, Cisco is definitely a force to be reckoned with. Its vast operations in servers is powerful and its routers are impeccable. With these 2 major forces in place, they are guranteed a safe spot in the market and thus will not be easily eliminated for sure.

"This is in reaction to Cisco and Tandberg," Kaufman Bros. analyst Shaw Wu said of the H-P and Polycom announcement. "It looks like H-P is opting to partner instead of acquire."

"Any type of video collaboration is critical at this point in the market," Skoba said in a phone interview. "There's a clear benefit to launching this technology."

With the expansion of business worldwide, video conferencing is omnipresent now.

You see all the business people holding video conferencing every where. Even in movies, you see the military using video conferencing to communicate with one another. Remember the scene in 2010 where the global leaders held a united conference to think of a solution to counter the demise of the world?

It is only until today that it has been made so prominent, that everyone is actually taking note of it.

The world is changing. Information technology is taking over.

Credits -marketwatch, -ecsrd, -liquidmatrix, -techfresh

The two companies also agreed to joint efforts to make Polycom's technology inter-operate with HP's Halo telepresence technology.

With Polycom under the tutelage of HP's operational management style, it will definitely prosper in the future. HP is famous for its "HP Way" and it is the reason why it has managed to expand its operations so vastly within a short period of time throughout these years.

On top of that, HP has also been expanding its operations in other fields such as networking solutions. HP acquired 3Com for that very sole purpose of expanding its market share in China. Also, it is experienced when it comes to competition. It has fought IBM and Dell before naturally HP has the upperhand as compared to Cisco.

Nonetheless, Cisco is definitely a force to be reckoned with. Its vast operations in servers is powerful and its routers are impeccable. With these 2 major forces in place, they are guranteed a safe spot in the market and thus will not be easily eliminated for sure.

"This is in reaction to Cisco and Tandberg," Kaufman Bros. analyst Shaw Wu said of the H-P and Polycom announcement. "It looks like H-P is opting to partner instead of acquire."

"Any type of video collaboration is critical at this point in the market," Skoba said in a phone interview. "There's a clear benefit to launching this technology."

With the expansion of business worldwide, video conferencing is omnipresent now.

You see all the business people holding video conferencing every where. Even in movies, you see the military using video conferencing to communicate with one another. Remember the scene in 2010 where the global leaders held a united conference to think of a solution to counter the demise of the world?

It is only until today that it has been made so prominent, that everyone is actually taking note of it.

The world is changing. Information technology is taking over.

Credits -marketwatch, -ecsrd, -liquidmatrix, -techfresh

Saturday, April 10, 2010

Exxon Mobil going ALL OUT

Exxon Mobil is seemingly walking the unconventional route to mine for oil.

Of the eight major projects the company plans to start up in the near future, six were unconventional. They include two liquefied natural gas facilities, in Qatar and Texas, an Arctic oil production facility in Sakhalin Island off Russia's far east coast, two deep water projects off Angola, and an oil sands project in Alberta, Canada.

Liquefied natural gas is harder to bring to market than regular gas. First the gas must be converted to liquid to transport it from its source in remote areas to where it can be used, generally close to major population centers. Then it must be converted back into a gas for usage.

Oil sands are a heavy, tar-like substance that requires lots of processing to turn into a usable oil. Shale gas lies in rock that must be cracked with chemicals and water to bring it to the surface. Projects in deep water or the Arctic require expensive infrastructure to reach the oil.

Honestly speaking, please do not expect the oil prices to go down because of two reasons that exacerbated the situation.

1. There is increasing demand for oil.

2. The supply of oil is becoming more inelastic than before, meaning to say that the supply is falling.

That is precisely why Exxon is now walking the unconventional path in the mining of oil.

In the past, Exxon enjoys mining a huge area of land for oil and people criticised their way of mining because they feel that Exxon could have just used technology to pin-point the enclosed area of land that has the most amount of oil.

But, Exxon proved all of them wrong but outwitting technology. In the end, Exxon managed to uncover an abundance amount of oil that technology could not detect.

However, right now, Exxon can no longer do that because the competition is extremely stiff. Many companies are joining in, in the tight search for oil. Hence, the only way to beat them is to mine the unconventional areas.

By doing that, the smaller companies cannot tag along because they simply do not have the necessary funds. It comes at an exorbitant cost in order to be able to mine the unconventional areas like the ocean and the sands and the liquified natural gas. Smaller companies will go bankrupt if they enter this field. What they can do now is only to stare at Exxon walking down the tight rope and hopefully try to learn some of the techniques they can use later on when they think that they can do it too.

Before the smaller companies build up their funds to join in, Exxon had better enter the unconvential field and mine whatever they can possibly mine and hopefully, they will be able to come up with a cheaper way of mining, perhaps by developing unique equipments that can enable them to mine more effectively.

No doubt this is going to be a dire period for Exxon, I'm sure they will prevail for they are famous for coming up with innovative ways to mine at a lower costs. On top of that, they make sure that the process of mining and distillation is handled carefully such that they can mine the optimum amount of yield from what they mined.

Definitely one of the powerhouse in the oil field, Exxon will not be defeated so easily for sure!

Credits -oceanquigley, -etftrends, -cnn

Of the eight major projects the company plans to start up in the near future, six were unconventional. They include two liquefied natural gas facilities, in Qatar and Texas, an Arctic oil production facility in Sakhalin Island off Russia's far east coast, two deep water projects off Angola, and an oil sands project in Alberta, Canada.

Liquefied natural gas is harder to bring to market than regular gas. First the gas must be converted to liquid to transport it from its source in remote areas to where it can be used, generally close to major population centers. Then it must be converted back into a gas for usage.

Oil sands are a heavy, tar-like substance that requires lots of processing to turn into a usable oil. Shale gas lies in rock that must be cracked with chemicals and water to bring it to the surface. Projects in deep water or the Arctic require expensive infrastructure to reach the oil.

Honestly speaking, please do not expect the oil prices to go down because of two reasons that exacerbated the situation.

1. There is increasing demand for oil.

2. The supply of oil is becoming more inelastic than before, meaning to say that the supply is falling.

That is precisely why Exxon is now walking the unconventional path in the mining of oil.

In the past, Exxon enjoys mining a huge area of land for oil and people criticised their way of mining because they feel that Exxon could have just used technology to pin-point the enclosed area of land that has the most amount of oil.

But, Exxon proved all of them wrong but outwitting technology. In the end, Exxon managed to uncover an abundance amount of oil that technology could not detect.

However, right now, Exxon can no longer do that because the competition is extremely stiff. Many companies are joining in, in the tight search for oil. Hence, the only way to beat them is to mine the unconventional areas.

By doing that, the smaller companies cannot tag along because they simply do not have the necessary funds. It comes at an exorbitant cost in order to be able to mine the unconventional areas like the ocean and the sands and the liquified natural gas. Smaller companies will go bankrupt if they enter this field. What they can do now is only to stare at Exxon walking down the tight rope and hopefully try to learn some of the techniques they can use later on when they think that they can do it too.

Before the smaller companies build up their funds to join in, Exxon had better enter the unconvential field and mine whatever they can possibly mine and hopefully, they will be able to come up with a cheaper way of mining, perhaps by developing unique equipments that can enable them to mine more effectively.

No doubt this is going to be a dire period for Exxon, I'm sure they will prevail for they are famous for coming up with innovative ways to mine at a lower costs. On top of that, they make sure that the process of mining and distillation is handled carefully such that they can mine the optimum amount of yield from what they mined.

Definitely one of the powerhouse in the oil field, Exxon will not be defeated so easily for sure!

Credits -oceanquigley, -etftrends, -cnn

Tuesday, April 6, 2010

Apple iPad

What iPad can't do.

1. It can't on the music while you are using the Facebook application so they cannot run simultaneously

2.

But those prices are for iPads with wireless Internet access only. If you want connectivity over the 3G cell phone Internet network, you'll have to add $130 to each iPad price, as well as the cost of a data plan (more on that later).

So for the most complete iPad experience, you'll need to shell out $830 for the device plus the monthly cost of 3G access. For that kind of cash, you could buy a full-fledged computer.

The monthly cost of the 3G access is kinda like a major turnoff? How can a fad cost so much? A toy should not be costing that exorbitantly!

3.Apple's Safari is the only Web browser for the iPad. Another bummer: Safari on iPad won't allow for tabbed browsing, which lets users keep several sites open at once in the same window

Also, as you all know, Flash is not able to run on iPad. That basically means that you will not be able to see short clips or videos on iPad. This stubborn move by Apple is bound to hit it hard later on.

That's one thing I can't understand. Why does Steve Jobs remove flash from his products? It's really enigmatic.

4. Film buffs will love this sharp, crisp display. But the iPad doesn't support the widescreen 16:9 format of most movies, so viewers will have to look at thick black edges on two sides -- or cut off some of the picture -- while they're trying to watch "Hot Tub Time Machine."

But like the iPhone and iPod, the battery is built in. So if it dies you can't simply pop in a new one; if the battery is broken, for all intents and purposes, so is your iPad.

The good news is that you only need to pay $99 if you battery wears out. However, if it is spoiled because of your carelessness, then that's it, it's the end.

The demise of your iPad.

Credits -cnn

1. It can't on the music while you are using the Facebook application so they cannot run simultaneously

2.

But those prices are for iPads with wireless Internet access only. If you want connectivity over the 3G cell phone Internet network, you'll have to add $130 to each iPad price, as well as the cost of a data plan (more on that later).

So for the most complete iPad experience, you'll need to shell out $830 for the device plus the monthly cost of 3G access. For that kind of cash, you could buy a full-fledged computer.

The monthly cost of the 3G access is kinda like a major turnoff? How can a fad cost so much? A toy should not be costing that exorbitantly!

3.Apple's Safari is the only Web browser for the iPad. Another bummer: Safari on iPad won't allow for tabbed browsing, which lets users keep several sites open at once in the same window

Also, as you all know, Flash is not able to run on iPad. That basically means that you will not be able to see short clips or videos on iPad. This stubborn move by Apple is bound to hit it hard later on.

That's one thing I can't understand. Why does Steve Jobs remove flash from his products? It's really enigmatic.

4. Film buffs will love this sharp, crisp display. But the iPad doesn't support the widescreen 16:9 format of most movies, so viewers will have to look at thick black edges on two sides -- or cut off some of the picture -- while they're trying to watch "Hot Tub Time Machine."

Hmmm, on prima facie I was thinking who the hell will watch a movie on an iPad?

But on second thoughts, I think it's kinda cool to watch it on the iPad screen with everyone around you looking at it at the same time, like a mini theatre so to speak.

5.The iPad boasts a 10-hour lifespan when playing video, and many reviewers have said the battery lasts even longer than Apple claims. And if you somehow manage to put the device down for an extended period of time, the battery will last a full month on standby.

But like the iPhone and iPod, the battery is built in. So if it dies you can't simply pop in a new one; if the battery is broken, for all intents and purposes, so is your iPad.

The good news is that you only need to pay $99 if you battery wears out. However, if it is spoiled because of your carelessness, then that's it, it's the end.

The demise of your iPad.

Credits -cnn

Boeing 787

Boeing Co. said Friday it will boost production of two of its most popular commercial jets to meet rising demand for new aircraft as a turnaround in the beaten-down airline sector makes steady gains.

"We see 2010 as the year of overall economic recovery within the industry and 2011 a year where airlines return to profitability," said Randy Tinseth, vice president of Marketing for Boeing Commercial Airplanes. "As a result, we anticipate an increase in demand for airplanes in 2012 and beyond."

I thought this article goes to that an economic recovery is truly imminent. It is for sure going to happen I predict. There's no way the economy will sink back again, at least now in 2011. But there's a possiblity that this economy will take a dip later in the year 2010 again.

Nonetheless, as we all know, Boeing has been through really tough and rough periods in the best as it hurries to churn out its touted Boeing 787 aircraft. It has met up with arduous obstacles along the way and was almost in the danger of being pulverised at one point in time due to the lack of results as the years went by.

Thankfully, it had managed to revived itself when everyone decided to give Boeing one last chance. I guess it's the adrenaline rush that pushed Boeing to the limits for it knew that it can never fail or it's the end for them.

As the aphorism goes, "What doesn't kill you makes you stronger." I'm sure this is the most apt description for Boeing right now.

It is fighting like a fierce bull, charging straight away into the unpredictable future with ultimate optimism where they decide that there will be a huge demand for aircrafts in 2012. I too believe that there will be a huge demand for aircrafts too because many airlines are trying to boost their number of airplanes along the way in search of more revenue.

This is a corollary as a result of the booming tourism industry. Even in the midst of the financial crisis, people are still flying all over the place, the only difference is that they have opted for a cheaper flight!

Credits -marketwatch, -anime-wallpaper, -fspilotshop

"We see 2010 as the year of overall economic recovery within the industry and 2011 a year where airlines return to profitability," said Randy Tinseth, vice president of Marketing for Boeing Commercial Airplanes. "As a result, we anticipate an increase in demand for airplanes in 2012 and beyond."

I thought this article goes to that an economic recovery is truly imminent. It is for sure going to happen I predict. There's no way the economy will sink back again, at least now in 2011. But there's a possiblity that this economy will take a dip later in the year 2010 again.

Nonetheless, as we all know, Boeing has been through really tough and rough periods in the best as it hurries to churn out its touted Boeing 787 aircraft. It has met up with arduous obstacles along the way and was almost in the danger of being pulverised at one point in time due to the lack of results as the years went by.

Thankfully, it had managed to revived itself when everyone decided to give Boeing one last chance. I guess it's the adrenaline rush that pushed Boeing to the limits for it knew that it can never fail or it's the end for them.

As the aphorism goes, "What doesn't kill you makes you stronger." I'm sure this is the most apt description for Boeing right now.

It is fighting like a fierce bull, charging straight away into the unpredictable future with ultimate optimism where they decide that there will be a huge demand for aircrafts in 2012. I too believe that there will be a huge demand for aircrafts too because many airlines are trying to boost their number of airplanes along the way in search of more revenue.

This is a corollary as a result of the booming tourism industry. Even in the midst of the financial crisis, people are still flying all over the place, the only difference is that they have opted for a cheaper flight!

Credits -marketwatch, -anime-wallpaper, -fspilotshop

Friday, March 26, 2010

The magic of 285 Apple Stores

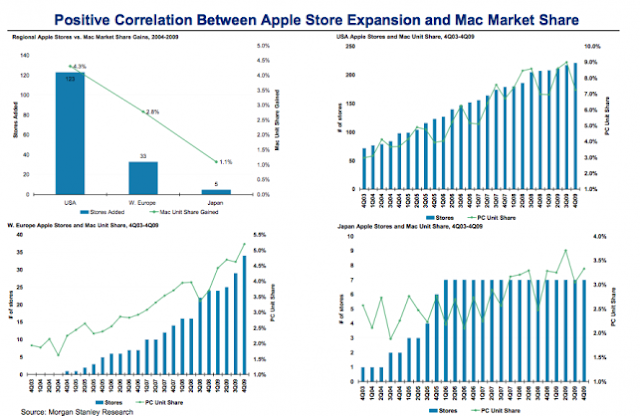

In a report to clients issued overnight Monday about Apple's (AAPL) opportunities for growth in China, Morgan Stanley's Katy Huberty adds, almost as a throwaway, the instructive charts at right (see also below the fold).

They show what she calls the "Positive Correlation Between Apple Store Expansion and Mac Market Share."

It seems flagrant that the accrued market share is a corrollary of the expansion of the number of Apple stores worldwide. Right now, Apple is planning to open up another 25 retail shops in China. This might be a perfect opportunity to expand in China given that Google has some conflicts with China at the moment.

It might be a once-in-a-lifetime opportunity to convert the Chinese into Apple fans!

Nonetheless, Apple still has many other opportunities elsewhere other than China. For instance, in Asia it is becoming more and more prominent where more and more teenagers are enticed by the iPhones and iTouch. Many are wowed by the number of applications and you can hear them talking about the up and coming applications of the day on the train everyday.

To be a topic of the day is HUGE!

The best form of marketing to date is for sure without a shadow of a doubt, the word-of-mouth marketing.

Imagine you yourself going up to the highest floorth in your country. Then, you pierce a pillow (which you have brought along) filled with feathers with a knife. Every single feathers will float along with as the wind gust and you will have no idea where each feather goes.

That is the power of the word-of-mouth. With the increasing number of shops as a concomitant, Apple is approaching invincibility.

I'm pretty sure that even though iPad was not a huge success, Apple will continue to move on with even greater success in the near future.

You have my word!

Credits -cnn, -charicemania, -cache4

They show what she calls the "Positive Correlation Between Apple Store Expansion and Mac Market Share."

It seems flagrant that the accrued market share is a corrollary of the expansion of the number of Apple stores worldwide. Right now, Apple is planning to open up another 25 retail shops in China. This might be a perfect opportunity to expand in China given that Google has some conflicts with China at the moment.

It might be a once-in-a-lifetime opportunity to convert the Chinese into Apple fans!

Nonetheless, Apple still has many other opportunities elsewhere other than China. For instance, in Asia it is becoming more and more prominent where more and more teenagers are enticed by the iPhones and iTouch. Many are wowed by the number of applications and you can hear them talking about the up and coming applications of the day on the train everyday.

To be a topic of the day is HUGE!

The best form of marketing to date is for sure without a shadow of a doubt, the word-of-mouth marketing.

Imagine you yourself going up to the highest floorth in your country. Then, you pierce a pillow (which you have brought along) filled with feathers with a knife. Every single feathers will float along with as the wind gust and you will have no idea where each feather goes.

That is the power of the word-of-mouth. With the increasing number of shops as a concomitant, Apple is approaching invincibility.

I'm pretty sure that even though iPad was not a huge success, Apple will continue to move on with even greater success in the near future.

You have my word!

Credits -cnn, -charicemania, -cache4

Thursday, March 25, 2010

Facebook Surpassed Google

"It shows content sharing has become a huge driving force online," said Matt Tatham, director of media relations at Hitwise. "People want information from friends they trust, versus the the anonymity of a search engine."

Well, the day has finally arrived.

Facebook triumphs Google. The point made by Tatham is very intriguing. Content sharing is becoming a huge driving force on the net.

I thought this is really a fact.

I personally always get the thrill and adrenaline rush when I post a status message on facebook and then I get lots of reply on my status message. Somehow, I feel very happy to reply to these messages even though that person replying to my message is actually on msn with me.

So right now, I'm thinking to myself, is it because we humans prefer to share the message with the rest and also, we are able to show off to the rest of our friends that we are popular in the sense that our message get tonnes of replies on it.

Right now, it becomes a competition to see who has the most number of replies. It's a vicious cycle.

Don't you think so? Come to think of it, when you see others getting lots of replies on that status messages and you getting none. Doesn't it makes you reflect on yourself? Whether all your friends doesn't like you?

But when you suddenly get lots of replies, you tend to study the trend. What is it that I have to type to get lots of replies.

Interesting isn't it? Now it becomes what I should type rather than what I want to type.

We've just been manipulated by the society and social network.

Google has recently came up with Google Buzz but it was a major flop. Perhaps if Google can come up with something better, then maybe they will trash facebook.

Otherwise, facebook will still take the lead for now.

Credits -cnn, -mythsandfacts

Wednesday, March 24, 2010

Google Uncensors

In a long-awaited announcement, Google said Monday that it will stop censoring search services on google.cn, its Chinese search site.

Google (GOOG, Fortune 500) is now redirecting its Chinese users to its Hong Kong site, google.com.hk, which offers uncensored search results, according to Google's company blog. Google's search site for Chinese users is now hosted on servers that are in Hong Kong.

Well, it seems that after much persuasion, China is still adamant about its stand on self-censorship. It appears that there is no way the burgeoning giant is going to let a step back on this one and that Google can only take a back seat and obey China on this one.

Nonetheless, as you guys can see, Google has decided to finally uncensor everything at the risk of offending China. They are currently testing the water by hosting their sites based in Hong Kong in order not to infringe the rights of China but even by doing so, their search services still can be banned within the borders of the country per se.

This also includes it Chrome services, its operating system and its Android services along with its online-advertising business.

It will have a huge impinge on Google if they were forced to leave altogether because these services hold a gargantuan amount of revenue for Google and has the potential to set the platform for Asia. China could jolly well be a pedestal for Google to step on in an attemp to reach the entire of the Asia in terms of spreading its clout and services as a giant corporation.

Nonetheless, China will most probably not do such a fatuous thing because it will leave a bad trademark on them if they were to ban Google altogether from China. It will have adverse effects on its public relations and the entire world will be scrutinizing China once again for barring the global giant from entering its market.

To be honest, the world is already scrutinizing China's operations. A while back, United States governors have already tried to request for a litigation against China for manipulating its currencies in an effort to support its exports business. By doing so, they are actually impeding United State's recovery as a result.

Also, China is notoriously infamous for its protectionism policies and thus it is really difficult for other businesses to thrive in China. Domestic industries are booming because they can export easily without much tax but they can't import because the import taxes are hefty due to a weak currency.

With so many eyes staring at China, I doubt they will self inflict damage on themselves by barring Google altogether.

Credits -cnn, -osmoothie, -amnesty, -sanssoucistu

Google (GOOG, Fortune 500) is now redirecting its Chinese users to its Hong Kong site, google.com.hk, which offers uncensored search results, according to Google's company blog. Google's search site for Chinese users is now hosted on servers that are in Hong Kong.

Well, it seems that after much persuasion, China is still adamant about its stand on self-censorship. It appears that there is no way the burgeoning giant is going to let a step back on this one and that Google can only take a back seat and obey China on this one.

Nonetheless, as you guys can see, Google has decided to finally uncensor everything at the risk of offending China. They are currently testing the water by hosting their sites based in Hong Kong in order not to infringe the rights of China but even by doing so, their search services still can be banned within the borders of the country per se.

This also includes it Chrome services, its operating system and its Android services along with its online-advertising business.

It will have a huge impinge on Google if they were forced to leave altogether because these services hold a gargantuan amount of revenue for Google and has the potential to set the platform for Asia. China could jolly well be a pedestal for Google to step on in an attemp to reach the entire of the Asia in terms of spreading its clout and services as a giant corporation.

Nonetheless, China will most probably not do such a fatuous thing because it will leave a bad trademark on them if they were to ban Google altogether from China. It will have adverse effects on its public relations and the entire world will be scrutinizing China once again for barring the global giant from entering its market.

To be honest, the world is already scrutinizing China's operations. A while back, United States governors have already tried to request for a litigation against China for manipulating its currencies in an effort to support its exports business. By doing so, they are actually impeding United State's recovery as a result.

Also, China is notoriously infamous for its protectionism policies and thus it is really difficult for other businesses to thrive in China. Domestic industries are booming because they can export easily without much tax but they can't import because the import taxes are hefty due to a weak currency.

With so many eyes staring at China, I doubt they will self inflict damage on themselves by barring Google altogether.

Credits -cnn, -osmoothie, -amnesty, -sanssoucistu

Friday, March 19, 2010

Roundup of Cars

We all know first it started with Toyota.

Toyota had a major problem with their brake pedal. There were consumers who complained that they had difficulty stopping the car and that some of the accidents were linked to the malfunctioning brake pedals.

This is what I find really intriguing.

Brake pedals are almost like the life of the car. Without a good brake pedal, the car will just keep moving and it can never avoid any accident with a close shave because the car cannot stop in time.

Nonetheless, Toyota was the first one to trigger off the chain effect. Look at the number of automobile manufacturers recalling their cars now.

Do you realise that such chain effects happen anywhere? I mean not just in this recalling, it happens in the airline business too. I remember a friend telling me, do you know that after an air plane crush, the number of air plane crushes that follow rise significantly?

So I asked why with my abysmal ignorance at that point of time and he replied, "Well, the other pilots are more apprehensive than before and a huge amount of pressure is piled onto them. Naturally they get more nervous and paranoid and the chances of screwing up is definitely higher than before, in fact, way higher than before."

Remember the time whereby you were so confident in getting an A for your test? After seeing so many failures, don't they dampen your hopes?

Same thing here.

Then we move on to Honda who recalled close to 1 million cars worldwide to replace the airbag inflator.

And now we have Mazda's overheating seats. Apparently the problem lies with the CX-9 seat heater which could not be turned off even though the ignition key was turned all the way to the off side.

I won't be surprised if more automobile manufacturers join in the fun. In fact, I'm pretty confident that a lot of other manufacturers will soon join in the recall game.

I mean on the positive note for them, it is not as conspicuous as before if you are going to do the recall now because everyone is doing it.

Imagine at the start, the amount of glaring scrutiny Toyota had to endure, it was painful, really painful.

Credits -businessweek, -zigswheel, -treehugger

Toyota had a major problem with their brake pedal. There were consumers who complained that they had difficulty stopping the car and that some of the accidents were linked to the malfunctioning brake pedals.

This is what I find really intriguing.

Brake pedals are almost like the life of the car. Without a good brake pedal, the car will just keep moving and it can never avoid any accident with a close shave because the car cannot stop in time.

Nonetheless, Toyota was the first one to trigger off the chain effect. Look at the number of automobile manufacturers recalling their cars now.

Do you realise that such chain effects happen anywhere? I mean not just in this recalling, it happens in the airline business too. I remember a friend telling me, do you know that after an air plane crush, the number of air plane crushes that follow rise significantly?

So I asked why with my abysmal ignorance at that point of time and he replied, "Well, the other pilots are more apprehensive than before and a huge amount of pressure is piled onto them. Naturally they get more nervous and paranoid and the chances of screwing up is definitely higher than before, in fact, way higher than before."

Remember the time whereby you were so confident in getting an A for your test? After seeing so many failures, don't they dampen your hopes?

Same thing here.

Then we move on to Honda who recalled close to 1 million cars worldwide to replace the airbag inflator.

And now we have Mazda's overheating seats. Apparently the problem lies with the CX-9 seat heater which could not be turned off even though the ignition key was turned all the way to the off side.

I won't be surprised if more automobile manufacturers join in the fun. In fact, I'm pretty confident that a lot of other manufacturers will soon join in the recall game.

I mean on the positive note for them, it is not as conspicuous as before if you are going to do the recall now because everyone is doing it.

Imagine at the start, the amount of glaring scrutiny Toyota had to endure, it was painful, really painful.

Credits -businessweek, -zigswheel, -treehugger

Wednesday, March 17, 2010

Nestle strikes back

Nestle strikes back is actually an understatement, because it has made a staggering total of $9.58 billion in profits for the year 2009.

It plans to buy back more shares and also, Nestle intends to raise its dividends to its shareholders. Nestle said it plans to raise its dividend by 14.3% to 1.6 francs a share and announced it would buy back around 10 billion francs of shares this year.

What's the rationale of buying back shares which you once offered to the public ?

Well, by buying back more shares, you lower the supply of the stocks to the public. When you lower the supply, ceteris peribus (meaning the demand doesn't change), the price of the stocks will rise. It makes sense right?

Since there are a lower number of stocks left in the market now, people who want them will naturally pay a higher price for them now. Now, the demand becomes inelastic, which is to say that the total revenue will rise even if the price of the stocks is increased.

With the increase in stock prices, Nestle's shareholders benefit as well because their stocks are now worth more. They can sell them at a way higher price than before. On top of that, they are getting a high dividends because of the improving business. Such accrual growth of their returns is coveted by many in the market.

"Our 2009 performance was broad-based across all categories and regions and demonstrates our ability to deliver in the short term whilst continuing to invest for the long term," said Chief Eexecutive Paul Bulcke.

There you have it, a combination of soft and hard. To deliver in the short term and at the same time, planning for the future. That is a genius concoction to success.

Recently, Nestle has bought Digiorno Pizza from Kraft. A shrewd move which is said to have been a great purchase.

1. It is cheaper than expected.

2. It can leap a mile with that business that Kraft has given up. The Digiorno pizza is one of the core business of Kraft's but now, they have sacrificed it for the sake of acquiring Cadbury.

Either way, it does not affect Nestle because they weren't interested in Cadbury to begin with.

As it builds itself up, it buys back more stocks and then the prices start to fly up. When it's really high, they do not need to be afraid that the price level will be saturated because they can emulate Warren Buffett's move, which is to split the stock up.

Then, the whole cycle repeats itself.

Credits -marketwatch, -topnews, -investing-schools, -stockxpert

It plans to buy back more shares and also, Nestle intends to raise its dividends to its shareholders. Nestle said it plans to raise its dividend by 14.3% to 1.6 francs a share and announced it would buy back around 10 billion francs of shares this year.

What's the rationale of buying back shares which you once offered to the public ?

Well, by buying back more shares, you lower the supply of the stocks to the public. When you lower the supply, ceteris peribus (meaning the demand doesn't change), the price of the stocks will rise. It makes sense right?

Since there are a lower number of stocks left in the market now, people who want them will naturally pay a higher price for them now. Now, the demand becomes inelastic, which is to say that the total revenue will rise even if the price of the stocks is increased.

With the increase in stock prices, Nestle's shareholders benefit as well because their stocks are now worth more. They can sell them at a way higher price than before. On top of that, they are getting a high dividends because of the improving business. Such accrual growth of their returns is coveted by many in the market.

"Our 2009 performance was broad-based across all categories and regions and demonstrates our ability to deliver in the short term whilst continuing to invest for the long term," said Chief Eexecutive Paul Bulcke.

There you have it, a combination of soft and hard. To deliver in the short term and at the same time, planning for the future. That is a genius concoction to success.

Recently, Nestle has bought Digiorno Pizza from Kraft. A shrewd move which is said to have been a great purchase.

1. It is cheaper than expected.

2. It can leap a mile with that business that Kraft has given up. The Digiorno pizza is one of the core business of Kraft's but now, they have sacrificed it for the sake of acquiring Cadbury.

Either way, it does not affect Nestle because they weren't interested in Cadbury to begin with.

As it builds itself up, it buys back more stocks and then the prices start to fly up. When it's really high, they do not need to be afraid that the price level will be saturated because they can emulate Warren Buffett's move, which is to split the stock up.

Then, the whole cycle repeats itself.

Credits -marketwatch, -topnews, -investing-schools, -stockxpert

Sunday, March 14, 2010

Coca Cola Bottles it Up

On 25 February 2010, Coke said that it would it would buy the North American business of Coca-Cola Enterprises in a deal that will result in about $4 billion in cash to shareholders of the bottler.

This is an extremely precarious move that will definitely harm the stock prices of Coca-Cola in one way or another. Why is this acquisition a precarious one?

"Don't forget the original strategy was to separate out Coke from the low-margin, high-capital-cost bottling business, an enterprise that was dragging down Coke's stock price."

Well, as mentioned, the bottling business runs on economies of scale. No doubt the cost price is not high, but you have to remember that the selling price of these bottles are not high either. Ultimately, the profits go to the people who created the drink, the ones with the formulae and the management of the business.

But, it is imperative for Coca Cola to do this.

1. Thave to spur innovation in the industry once again.

The industry is now extremely competitive as the juices are gaining a lot of market share from the soda industry right now.

By acquiring the bottling business, it is for sure instrumental for they can now make many more decisions like making of smaller bottles, changing of the designs of the bottles, means of distribution of the bottles, etc.

It is easier for time to come up with new strategies that tie hand in hand with the bottles now. You have to stand out on the shelves now, branding is already over for Coca-Cola.

They need a revitalisation strategy.

2. They have to stop the rivalry between them and the bottling business once and for all.

2. Coca-Cola has been trying to deviate slightly from its soda drink business and they are trying to gain some market share from the popular juice section.

Today, a lot of the consumers are pretty much trying to be more health conscious. The thought that they are going to gulp down 10 teaspoons worth of sugar just by drinking Coke is definitely worse than a macabre death for some. It is unthinkable!

Imagine how much exercise you have to do in order to burn away that 10 teaspoon of sugar you've just consumed.

But here comes another problem. Due to the smaller scale of production of juices as compared to the brobdingnagian volume of Coke, the production costs for the bottles for the juices will be high. This will further reduce profit for the bottling industry as costs incurred surge once again.

Everytime they made a new decision, the bottling companies of Coca-Cola will question as to why they made such a fatuous decision.

Having a rivalry between the supplier and the manufacturer is definitely a no-no in business. It is pivotal to maintain a healthy and rich relationship among everyone in the chain of business.

So, all in all, we will be seeing new innovations on the bottle along with new drinks on the shelves soon.

Stay tune!

Credits -moreheadstate, -informationarchitect, -marketwatch, -paindainsight

This is an extremely precarious move that will definitely harm the stock prices of Coca-Cola in one way or another. Why is this acquisition a precarious one?

"Don't forget the original strategy was to separate out Coke from the low-margin, high-capital-cost bottling business, an enterprise that was dragging down Coke's stock price."

Well, as mentioned, the bottling business runs on economies of scale. No doubt the cost price is not high, but you have to remember that the selling price of these bottles are not high either. Ultimately, the profits go to the people who created the drink, the ones with the formulae and the management of the business.

But, it is imperative for Coca Cola to do this.

1. Thave to spur innovation in the industry once again.

The industry is now extremely competitive as the juices are gaining a lot of market share from the soda industry right now.

By acquiring the bottling business, it is for sure instrumental for they can now make many more decisions like making of smaller bottles, changing of the designs of the bottles, means of distribution of the bottles, etc.

It is easier for time to come up with new strategies that tie hand in hand with the bottles now. You have to stand out on the shelves now, branding is already over for Coca-Cola.

They need a revitalisation strategy.

2. They have to stop the rivalry between them and the bottling business once and for all.

2. Coca-Cola has been trying to deviate slightly from its soda drink business and they are trying to gain some market share from the popular juice section.

Today, a lot of the consumers are pretty much trying to be more health conscious. The thought that they are going to gulp down 10 teaspoons worth of sugar just by drinking Coke is definitely worse than a macabre death for some. It is unthinkable!

Imagine how much exercise you have to do in order to burn away that 10 teaspoon of sugar you've just consumed.

But here comes another problem. Due to the smaller scale of production of juices as compared to the brobdingnagian volume of Coke, the production costs for the bottles for the juices will be high. This will further reduce profit for the bottling industry as costs incurred surge once again.

Everytime they made a new decision, the bottling companies of Coca-Cola will question as to why they made such a fatuous decision.

Having a rivalry between the supplier and the manufacturer is definitely a no-no in business. It is pivotal to maintain a healthy and rich relationship among everyone in the chain of business.

So, all in all, we will be seeing new innovations on the bottle along with new drinks on the shelves soon.

Stay tune!

Credits -moreheadstate, -informationarchitect, -marketwatch, -paindainsight

Friday, March 12, 2010

Cisco Pays, Not

Cisco Systems has nearly $40 billion in cash (Madness). Maybe when Cisco gets to $50 billion it will finally feel comfortable using some of that moolah to pay a dividend.

To that end, Cisco says on its investor relations Web site that while the company "routinely" evaluates whether to pay a dividend, it believes that the stock buyback program and strategic investments "are in the best interest of our shareholders."

The above mentioned is the point of view from the management.

But most of the public who invested in the company yearn for dividends instead of the company making acquisitons and investments.

Hmmm... I find it pretty intriguing in the sense that should is this a long term versus short term conundrum again?

For the people looking into the long term, there is a proclivity for the liking towards the invested company pouring the money into R&D instead and eventually the money will come back to them.

What if I tell you that the company has been doing R&D for the past few decades already and they have made billions out of it, but none of it went into the investors' pockets.

Don't you think it's more of a vicious cycle here? This is the case where the company just made future promises and that future just never seems to solidify.

Conversely, you might think of people who ask for a return/dividend as being myopic. But how sure are you that they weren't once the people who thought about the long-term goal in the past?

Perhaps, they have waited far too long for the return that they just lost all their patience.

I trust that this case is synonymous to the infamous remuneration versus culture point in all corporate organisations.

Some companies believe that a great culture will motivate people and that random events will boost morale. However, does that mean that you can cut back on the incentives like bonuses and perquisites?

The answer is no. In actual fact, we humans need both soft and hard. Soft as in culture and hard as in cold-hard cash. It is imperative that we strike and sustain that impeccable balance throughout in order to stay at the top.

There will be a point in time whereby an increment in pay will not satisfy us anymore. Till then, we will need the culture to boost our pride and morale.

Similarly in Cisco's case, I believe that they should pay dividends once in a while for people to buy into their strategic long term plan.

Otherwise, people might just leave for other companies like Hewlett-Packard or IBM.

Credits -cnn, -skymetercorp, -smh, -banksavingsaccounts, -informationr

To that end, Cisco says on its investor relations Web site that while the company "routinely" evaluates whether to pay a dividend, it believes that the stock buyback program and strategic investments "are in the best interest of our shareholders."

The above mentioned is the point of view from the management.

But most of the public who invested in the company yearn for dividends instead of the company making acquisitons and investments.

Hmmm... I find it pretty intriguing in the sense that should is this a long term versus short term conundrum again?

For the people looking into the long term, there is a proclivity for the liking towards the invested company pouring the money into R&D instead and eventually the money will come back to them.

What if I tell you that the company has been doing R&D for the past few decades already and they have made billions out of it, but none of it went into the investors' pockets.

Don't you think it's more of a vicious cycle here? This is the case where the company just made future promises and that future just never seems to solidify.

Conversely, you might think of people who ask for a return/dividend as being myopic. But how sure are you that they weren't once the people who thought about the long-term goal in the past?

Perhaps, they have waited far too long for the return that they just lost all their patience.

I trust that this case is synonymous to the infamous remuneration versus culture point in all corporate organisations.

Some companies believe that a great culture will motivate people and that random events will boost morale. However, does that mean that you can cut back on the incentives like bonuses and perquisites?

The answer is no. In actual fact, we humans need both soft and hard. Soft as in culture and hard as in cold-hard cash. It is imperative that we strike and sustain that impeccable balance throughout in order to stay at the top.

There will be a point in time whereby an increment in pay will not satisfy us anymore. Till then, we will need the culture to boost our pride and morale.

Similarly in Cisco's case, I believe that they should pay dividends once in a while for people to buy into their strategic long term plan.

Otherwise, people might just leave for other companies like Hewlett-Packard or IBM.

Credits -cnn, -skymetercorp, -smh, -banksavingsaccounts, -informationr

Subscribe to:

Posts (Atom)