Asian stock markets plummeted on Friday following carnage in the US and European markets over fears the world was heading towards another financial crisis.

Already-fragile investor confidence was hammered by more weak US economic data and a warning from the head of the European Commission that the eurozone debt crisis had likely spread to other economies.

"It's going to be a very ugly end to an even uglier week," IG Markets analyst Ben Potter said in Sydney, adding that all sectors were expected to take a battering.

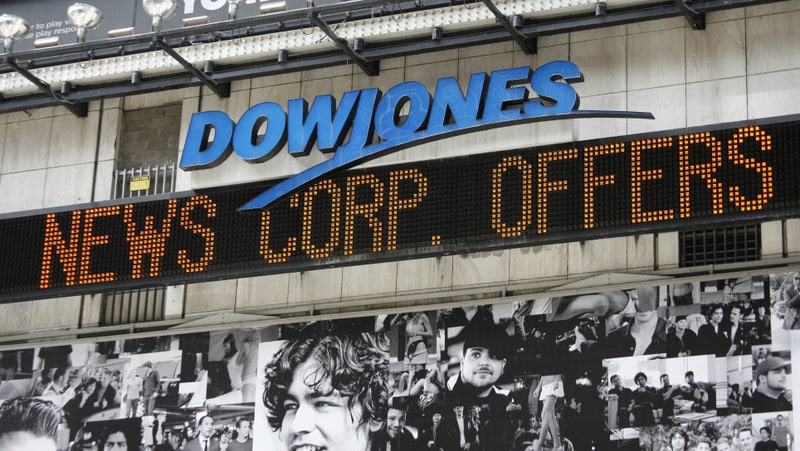

Fear swept across Asia from Europe and the United States, where the Dow Jones Industrial Average suffered its worst one-day drop since December 2008 to close 4.3 percent lower at 11,383.68, erasing all this year's gains.

"We're seeing the erosion and now the loss of confidence, confidence in the economy, confidence in the market, confidence in the policy makers. It's all showing up," said US-based Hugh Johnson, of Hugh Johnson Advisors.

Weak jobs data out of the United States on Thursday fuelled concerns among some analysts that the world could be heading towards another recession following the 2008 financial crisis.

The US Labor Department reported that weekly claims for unemployment benefits remained at a high 400,000 last week.

Those figures followed data this week showing manufacturing growth in the United States, Europe and Asia had come to a virtual standstill.

"There is a deep concern about global growth and of the state of play in the United States in particular," said City Index analyst Giles Watts.

"Traders are growing increasingly concerned about a sharp slowdown in US economic activity in the third quarter."

Eyes will be on the United States later Friday when Washington releases key government jobs data and a weaker-than-expected result could lead to a further sell-off.

European Commission chief Jose Manuel Barroso on Thursday urged eurozone leaders to re-think their currency's financial defences, admitting debt contagion has now spread.

"It is clear that we are no longer managing a crisis just in the euro-area periphery," Barroso warned in a letter sent to the 17 eurozone leaders.

A July 21 deal on a second bailout for Greece worth $226 billion has failed to prevent sharply higher debt-risk premiums for Italy and Spain, the eurozone's third and fourth-largest economies.

His comments came as the European Central Bank announced it would resume emergency credit-easing measures, some of which were last enacted at the height of the financial crisis.

But the ECB's efforts still failed to restore confidence. The risk premium investors demand to buy Spanish 10-year bonds over safe-bet German debt shot back up to near a record high on Thursday.

The eurozone debt crisis has put Italy and Spain under huge pressure in recent weeks after Greece, Ireland and Portugal had to be bailed out by the European Union and the International Monetary Fund.

On currency markets the dollar held some of the gains it made against the yen Thursday after Tokyo stepped in to sell the Japanese unit as it edged towards a record high.

The greenback was at 78.43 yen, after rising close to 80 yen in the first few hours following Tokyo's intervention. However, some analysts said the possibility of a further intervention was supporting the dollar.

And Minister of State for Economic and Fiscal Policy Kaoru Yosano suggested more market action may follow, saying "it would be too hasty to think Thursday's intervention was a one-off measure".

However the euro slipped versus the yen as investors became more risk averse. The single currency fell to 111.05 yen from 111.27 yen in New York late on Thursday, while it gained to $1.4158 from $1.4100.

"The fear of a double-dip recession with the slowdown in the US and the sovereign debt situation in Europe is having everybody biting their nails," said Adam Sieminski, chief energy economist of Deutsche Bank.

New York's main contract, West Texas Intermediate light, sweet crude for delivery in September, was down $1.10 to $85.53 a barrel in afternoon trade after plunging $5.30, or 5.8 percent, in US trade Thursday.

It was the lowest closing price for WTI since February.

Brent North Sea crude for September delivery inched up four cents to $107.29 after falling $5.98, or 5.3 percent, in London trade.

"The economic data from the US look pretty disappointing, many investors wanted to get out of the markets in anticipation of recession," Samuel Securities economist Lana Soelistyaningsih said.